How to Build a Quantum Computing Compliance Risk Framework for Financial Firms

How to Build a Quantum Computing Compliance Risk Framework for Financial Firms

Quantum computing is no longer a distant concept; it's rapidly becoming a reality that financial institutions must prepare for.

As quantum technology advances, it poses significant challenges to current encryption methods, potentially compromising sensitive financial data.

This guide outlines a comprehensive framework to help financial firms navigate the emerging quantum landscape and ensure compliance with evolving standards.

Table of Contents

- Understanding Quantum Threats

- Regulatory Landscape

- Building a Compliance Framework

- Implementing Post-Quantum Cryptography

- Strategic Steps Forward

Understanding Quantum Threats

Quantum computers leverage principles of quantum mechanics to perform computations at speeds unattainable by classical computers.

This capability threatens traditional encryption algorithms like RSA and ECC, which secure most financial transactions today.

According to the Cloud Security Alliance, quantum computers could break these encryption methods, exposing financial data to potential breaches.

Moreover, the "Harvest Now, Decrypt Later" strategy involves adversaries collecting encrypted data now, intending to decrypt it once quantum capabilities mature.

Regulatory Landscape

Regulatory bodies are proactively addressing quantum threats.

The Financial Services Information Sharing and Analysis Center (FS-ISAC) has released guidance emphasizing the need for quantum-resilient cryptography in the payment card industry.

Similarly, the National Institute of Standards and Technology (NIST) is developing post-quantum cryptographic standards to replace vulnerable algorithms.

Financial firms must stay abreast of these developments to ensure compliance and protect their operations.

Building a Compliance Framework

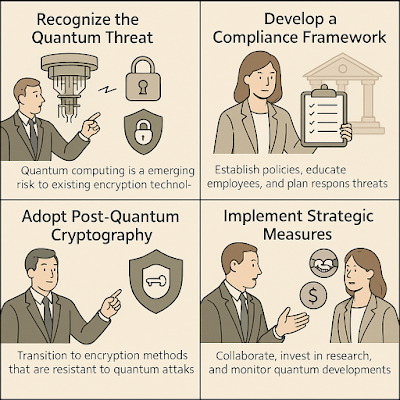

Developing a quantum computing compliance risk framework involves several key steps:

- Risk Assessment: Identify systems and data vulnerable to quantum attacks.

- Policy Development: Establish policies that mandate the use of quantum-safe encryption methods.

- Employee Training: Educate staff about quantum risks and the importance of compliance measures.

- Incident Response Planning: Update response plans to address potential quantum-related security breaches.

By integrating these elements, firms can create a robust framework that mitigates quantum risks.

Implementing Post-Quantum Cryptography

Transitioning to post-quantum cryptography (PQC) is crucial.

NIST's ongoing efforts aim to standardize PQC algorithms resistant to quantum attacks.

Financial institutions should begin evaluating and implementing these algorithms to secure their systems proactively.

Early adoption not only enhances security but also demonstrates a commitment to regulatory compliance.

Strategic Steps Forward

To stay ahead of quantum threats, financial firms should consider the following strategic actions:

- Collaborate with Industry Peers: Share knowledge and best practices for quantum preparedness.

- Engage with Regulators: Participate in discussions to shape future compliance requirements.

- Invest in Research: Support initiatives that explore quantum-safe technologies and their applications in finance.

- Monitor Technological Advances: Keep abreast of developments in quantum computing to anticipate potential impacts.

Proactive engagement in these areas will position firms to navigate the quantum era effectively.

Key Keywords: Quantum Computing, Financial Compliance, Post-Quantum Cryptography, Regulatory Framework, Risk Management

Discover state-specific wage theft solutions.

Launch secure expert witness platforms.

Build smart retainer billing systems.

License foreign investment solutions.